Meme stocks are back, and one specific meme stock in particular has been surging.

I’m talking about GameStop, which rose to prominence thanks to ‘Roaring Kitty’ and Reddit’s ‘Wallstreetbets’ faze during the Covid lockdown era.

Once again the meme stock GME is costing short sellers a pretty penny, to the tune of over $1 Billion dollars in losses just from a few days of the stock running up in value. Then again, no one ever feels bad for costing short sellers!

Why is all this happening again?

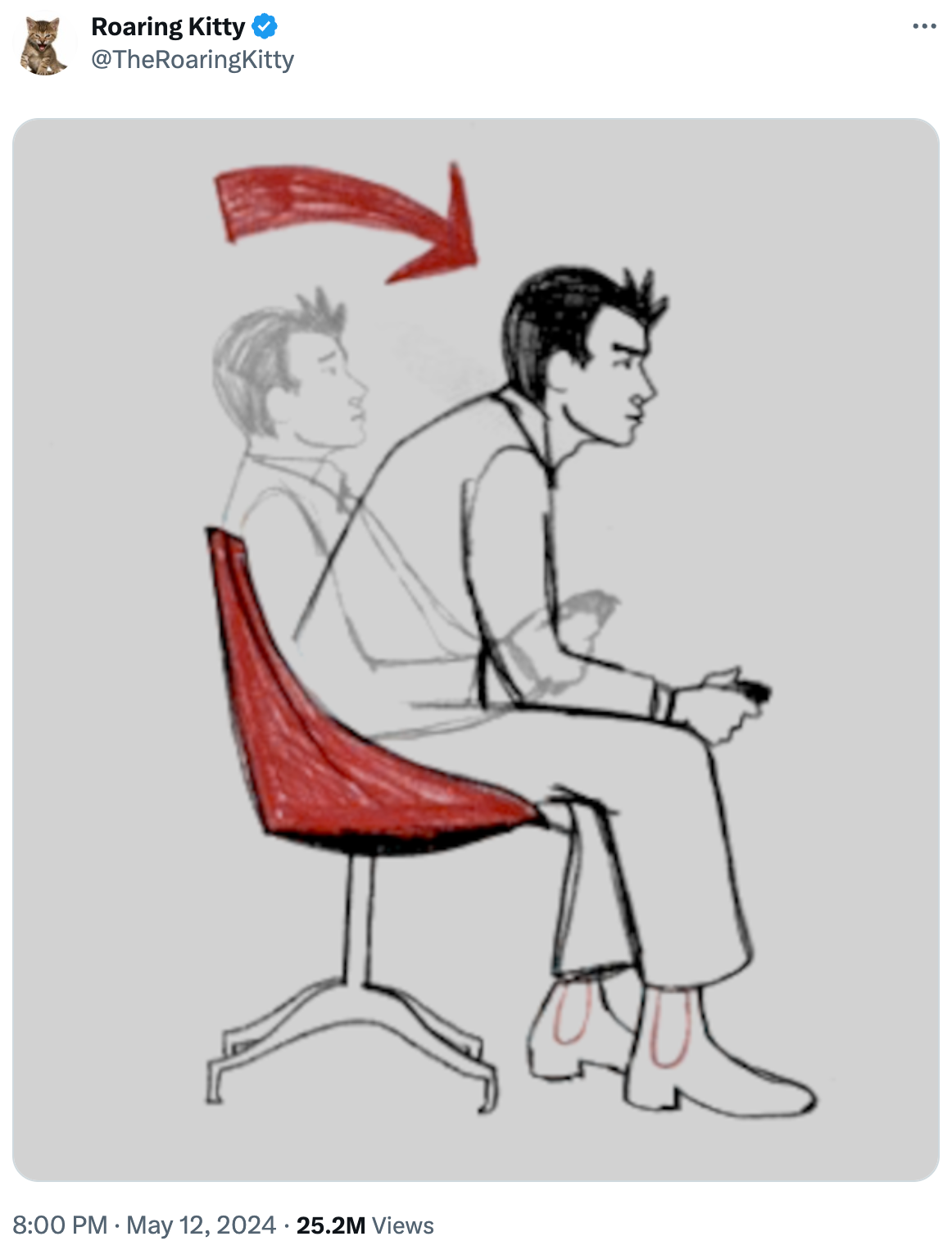

You can attribute the recent volatility in GameStop to a single tweet sent out by Roaring Kitty on May 12 that shows a gamer sitting up, as if to say the GameStop has Roaring Kitty’s attention again, or at least that’s how his fandom have reacted.

It’s not just GameStop whose stock is on fire lately. All the usual suspects of meme stocks have seen their prices rise, including AMC and newly IPOed Reddit.

And it’s not like GameStop’s financials have turned around, in fact the company is probably doing worse than ever.

According to Wedbush analyst Michael Pachter who covers GameStop he said in an interview with CNBC “I don’t know of anything fundamental that would drive the stock this high. They are not in a position to be profitable. They made $6 million last year and burned cash, and we expect them to lose $100 million a year going forward.”

So that doesn’t sound like positive news that would drive the stock higher.

Could it be that a single tweet after years of silence, from the unofficial leader of inflicting pain on short sellers, could be responsible for driving up GameStop’s stock price by more than 150% in a single week?

Welcome to meme stocks!

If you need a refresher on the whole GameStop/meme stock era all you have to do is watch the 2023 movie “Dumb Money”, which cronicle’s “Roaring Kittys” battle with billionaire investors like Gabe Plotkin’s Melvin Capital who lost so much money it had to shut down, and Ken Griffin’s Citadel, which also lost billions shorting GameStop.

Speaking of good timing, AMC decided the recent run up in their stock price by 30% presented a great opportunity to sell additional shares in the company to raise $250 million in desperately needed cash. Just how poorly have things been going over at AMC? Well, in 2023 the company had a net loss of $318.8 million dollars, which if you want to look on the bright side is an improvement year-over-year because in 2022 they lost $409.1 million dollars. So things are getting “better” if you will, but when you’re losing hundreds of millions of dollars a year, and consumers aren’t coming back to the movies like they did in the “before times”, then you have some financial issues you’re probably going to want to take care of soon.

GameStop jumps 70% as trader ‘Roaring Kitty’, who drove meme craze, posts again